The smart Trick of ssn That Nobody is Discussing

The smart Trick of ssn That Nobody is Discussing

Blog Article

Once you've your EIN Number, you may commence to open up a non-US resident LLC checking account and proceed on with your enterprise.

We make signing up for your personal my Social Security account handy so that you can skip the journey!

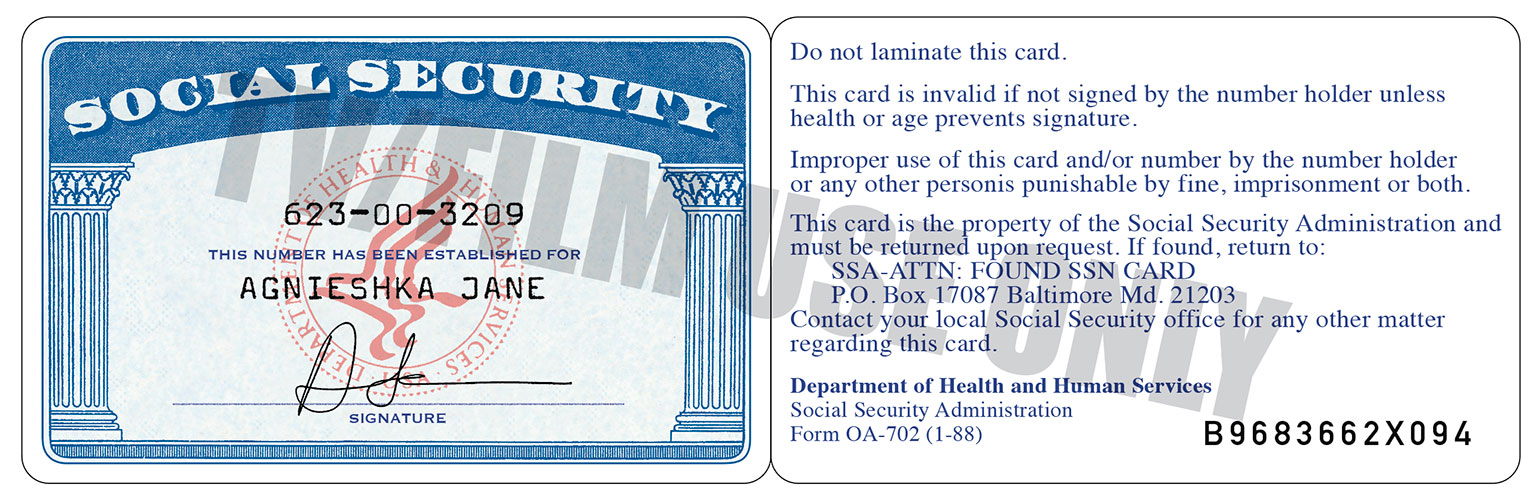

Whatever the technique, you will not be billed to submit an application for or receive the new card, which must get there from the mail in fourteen times following your application is processed. Your Social Security number will not likely transform.

If you feel you’ve waited long plenty of, but still haven’t gained your EIN approval, you could contact the IRS and ask for an EIN Verification Letter (147).

It’s some a bummer foreigners can’t get it done online or by email. Can you employ an online printing and mailing services like letterstream.com?

I called the IRS while you prompt (one.two months after fax), plus the agent corroborated the forty five business days and stated they'd introduced a Memo and are requiring a lot more paperwork from international applicants. He explained, some can get rejected if it appears These are submitting the LLC to stay away from taxes of their dwelling country ( no nexus in the US).

You could receive a phone from a person impersonating a Medicare consultant who attempts to persuade you to purchase a Medicare flex card. Many of these gives for pay learn more about new social-security-card-online-ssn as you go debit cards — offered by private Medicare Edge designs — could be reputable, but often they’re supplied by criminals who entice you into sharing personal facts they then use to steal your id or post faux Medicare statements as part of your title.

just how long it can just take to more information about social-security-card-online-ssn obtain EIN at present, normally I used to fax IRS for EIN but now it can be taking extra time as before, any motive, thank you

It removed the significance of the highest group number assigned for every spot number; the Higher Team Checklist as a result is frozen in time and may be used for validation of only those SSNs issued in advance of randomization.

It is achievable to get a new number, but only in extremely particular situations. Such as, Social Security can assign you a whole new number if you can exhibit that you will be in danger resulting from domestic violence or other abuse or are experiencing major, social security card ongoing money harm because of identification theft. But the process is challenging.

Web site 2 is simply an informational site so you don’t must submit it into the IRS. While, in case you materialize to deliver in Website page two, don’t fret, the IRS will just toss it away.

For anyone who is submitting SS-4 by mail, you don’t really have to enter a fax number. You'll be able to depart this vacant.

This address really should be one that is dependable and where you can routinely get mail in your LLC. This should also be the handle that you will use when filing potential tax returns with the IRS.

Hi Katie, typically it is possible to generate a letter to the IRS describing your situation and demonstrating evidence of the correct. Nevertheless, we only specialise in LLCs, so I’m unsure I’m answering your issue as very best I could.